Last Updated on August 5, 2023 By Emma W. Thomas

Gas line insurance isn’t legally required, but it may provide peace of mind for homeowners. It typically covers repairs to gas lines, protecting against potential leaks and damages. Assess your property’s risk and consider costs before deciding on its necessity.

5 Reasons Why Gas Line Insurance is Necessary

Gas line insurance is an additional coverage option offered by many home insurance companies. While it may seem like an unnecessary expense, there are several compelling reasons why you should consider getting gas line insurance. Here are five reasons why gas line insurance is necessary:

- Protection against costly repairs: Gas line repairs can be incredibly expensive. When a gas line in your home becomes damaged or starts leaking, it requires immediate attention from a qualified professional. The cost of repairing or replacing a gas line can easily run into hundreds or even thousands of dollars. Having gas line insurance ensures that you are protected financially in the event of such repairs.

- Coverage for accidents: Gas line accidents can lead to serious consequences, such as fires, explosions, or carbon monoxide leaks. These accidents can result from various factors, including aging infrastructure, natural disasters, or even human error. If a gas line accident occurs, the damage can be extensive both to your property and potentially to your neighbors’ properties as well. Gas line insurance provides coverage for accidents, giving you peace of mind knowing that you are protected against unforeseen circumstances.

- Peace of mind for homeowners: As a homeowner, it is natural to worry about potential risks and hazards that can affect your property. Gas line issues are among the most significant concerns for homeowners, particularly in older homes with aging pipes. By investing in gas line insurance, you can alleviate some of this worry and have the peace of mind that any gas line-related problems will be promptly addressed without incurring exorbitant costs.

- Comprehensive coverage: Home insurance policies typically do not include coverage for gas lines. While they may cover some damage caused by gas line accidents, they often exclude the cost of repairing the actual gas line itself. Gas line insurance fills this gap, providing comprehensive coverage specifically tailored for gas line repairs, replacements, and related issues. It ensures that you have adequate financial protection in case of any unforeseen gas line problems.

- Time-saving convenience: Dealing with gas line issues can be time-consuming and complicated. From identifying the problem to finding a qualified technician, the entire process can be a hassle. With gas line insurance, you can easily navigate this process. Insurance providers often have a network of trusted professionals who can quickly address the issue for you. This saves you time and effort in finding reliable service providers on your own.

How Much Does a Gas Line Insurance Can Cost in the USA

Gas Line Insurance is an essential investment for homeowners in the USA. It provides financial protection against costly repairs and replacements of gas lines if they become damaged or faulty. The cost of gas line insurance can vary depending on several factors, including the provider, coverage options, and location. In this listicle, we will explore how much gas line insurance can cost in the USA.

- Average Cost: On average, homeowners can expect to pay between $100 and $250 per year for gas line insurance. This cost may fluctuate depending on the state and city you reside in. Some providers offer discounts for bundling gas line insurance with other home insurance policies.

- Residential Coverage: Gas line insurance providers typically offer coverage for both interior and exterior gas lines. Interior coverage covers repairs or replacements of gas lines inside your home, while exterior coverage protects the lines between your home and the gas meter.

- Additional Coverage Options: Some insurance companies offer additional coverage options that can increase the cost. These include coverage for damages caused by natural disasters, such as earthquakes or floods, or coverage for appliances attached to the gas lines, like stoves or water heaters.

- Location: The cost of gas line insurance can vary depending on where you live in the USA. For example, homeowners in high-risk areas prone to earthquakes, hurricanes, or freezing temperatures may experience higher premiums due to increased chances of gas line damage.

- Insurance Provider: Different insurance providers offer varying rates for gas line insurance. It is essential to shop around and compare quotes from multiple companies to find the most competitive price. Consider factors like their reputation, customer reviews, and the extent of coverage provided.

- Deductibles: Like most insurance policies, gas line insurance often comes with a deductible. The deductible is the amount you are responsible for paying out-of-pocket before the insurance coverage kicks in. Higher deductibles can lead to lower premiums, but it’s essential to evaluate the potential costs of repairs or replacements against the savings in premiums.

What Is A Gas Line/ Utility Line Insurance?

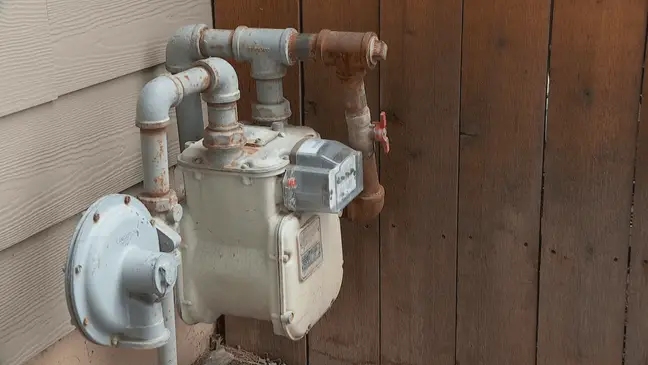

Gas line coverage is a type of insurance that covers gas pipes that supply natural gas to your house. This insurance covers both underground pipes and those above the ground. In case of damage, the insurance company caters for repairs to restore the supply of gas to your kitchen. Utility line insurance works the same way, only that it covers more resources. Most utility line insurance covers electric wires, phone lines, gas, water, and sewage connectivity.

Utility line maintenance and repair can be quite costly, and insurance helps you prepare for such instances. Some homeowner’s insurance packages actually cover utility lines, and it is important to check with them before buying any extra coverage.

It would be best if you also considered what part of your gas line you are responsible for. In most cases, the gas company is responsible for the gas line up to the street outside your house. You are only responsible for what’s going into your home from the meter. If the line you are responsible for is small, the repairs may be simple and less expensive, and quite rare. In such a scenario, you may opt to forgo the insurance and save up an emergency amount.

A sure way to determine if you need gas line insurance for your house is to do the math. We all buy insurance hoping never to use it but consider how much it would cost if you need a repair. For example, if your underground gas line fails and can cost you around $7-$10k to have it repaired, and you are required to pay about $50, or below per year in insurance, you can opt for the insurance. It would take 100 years of paying premiums to cover just one gas line fail or leak in such a scenario. If your insurance premiums are unreasonably priced, you can stay without the insurance since it’s unlikely for the gas line to fail.

What Does A Normal Homeowner’s Insurance Cover?

Homeowners’ insurance policies cover a variety of damages that happen in the entire home and not just the service lines. Some packages offer coverage for damage that affects a home’s structural integrity, foundations, furniture, and furnishings. The damage could be brought about by windstorms, tornadoes, fire, and such.

Some homeowner’s insurance coverage also covers service lines by default. If your policy covers service lines, then there’s no need to get gas line insurance as it is pretty much the same thing.

What’s Covered By Utility Line Coverage?

Utility line coverage is an insurance policy that’s mostly purchased separately from your homeowner’s insurance and provides coverage to utility lines that connect your home to wider utility grids. These policies provide coverage for damage that could be caused by various disasters. They cover damage from rodents, wear and tear, and environmental damage.

Rodents can make your experience as a homeowner stressful when they get to your utility lines. They burrow underground and can damage service lines leading to your house. Utility line insurance covers this possibility and gives you peace of mind. In case of rodent damage, your insurance will cover repairs and eradication of the rodents. If you buy a house in an area prone to rodents, you should consider adding this policy to your homeowner’s insurance.

Some homeowner’s insurance coverage does not cover regular wear and tear damage, but utility line insurance does. Wear and tear refer to damage that occurs to your service line from everyday use. Wear and tear damage is always prone to happen regardless of your efforts to protect your utility lines. If you live in a place where utility lines are exposed to harsh weather or usage, utility line insurance is unavoidable for you.

Gas lines and other utility lines can also be damaged by environmental factors such as wind or overgrown tree roots. Always ensure your utility line insurance covers such eventualities as it takes off much weight off your shoulders.

How Do I Buy Utility Line Insurance?

Depending on your situation, location, and contents of your homeowner’s insurance, utility line insurance can be valuable and worth paying for. You can get utility line insurance by adding it to your homeowner’s policy or getting it from your service provider. We recommend adding it to your policy since it is cheaper and more effective.

Check with your homeowner’s insurance company to find out if they offer service line insurance by default. Some companies offer this cover s an optional add-on that you choose to add to your existing policy. There are many benefits to choosing to add utility insurance to an existing policy instead of opening another account. Here are some of the benefits:

- Its easier to work with a company you are familiar with

- You don’t need to add another bill or open n account for utility lines only

- It’s cheaper since you only need to add about $15 per month to your regular premiums and have all your service lines covered

You can also opt to buy insurance from your service providers. This works by purchasing gas line insurance from the gas company, electric line insurance from the electricity company, and so on. The main advantage of choosing this type of insurance is that you can select which lines you want to be covered. If your homeowner’s insurance excludes a particular line, you can cover it using this method. The downside to this option is that it is expensive in the long run. For more information on how you can go about it, consult the local service provider of the line you want to insure.

Conclusion

Gas line insurance or utility line insurance should be included in your homeowner’s insurance. It covers all repair and maintenance costs in case of damage to your utility lines. These lines rarely get damaged, but when they do, the cost of repair is hefty. Homeowners need to ensure that their insurance covers this cost. Some homeowners’ insurance packages only cover a portion of the cost, but that goes a long way in relieving the burden. If your package doesn’t cover utility lines, it is mostly because the cost of the repairs is not much.

You wouldn’t need gas line insurance if it were included in your homeowner’s insurance package. If it is not included, try to find out which part of the gas line is your responsibility and estimate the repair cost in case of damage. If the repair cost is way less than what you’ll pay on premiums, you won’t need gas line insurance. Instead, have a significant amount of money set aside for emergency repairs. If premiums are less compared to the cost of repair, then you will need an insurance plan.

In case you need utility line insurance, first consult with your home insurance company. Working with familiar people makes it easier, and you can negotiate a better deal. This consultation will also help you determine whether you need extra coverage. You will find that you don’t and you will save money you would have paid to another company in most cases. After consulting with your company, you can go ahead and ignore all those emails about getting gas insurance. We hope this post enlightens you to understand your homeowners’ insurance and when you need to ensure utility lines.

References:

https://www.fox26houston.com/news/should-you-buy-home-gas-line-insurance

https://www.khou.com/article/news/local/verify/verify-do-you-really-need-a-gas-line-insurance-plan/285-f69ea92b-2dff-4a1e-aba1-14c9b23fab3e

Emma is a graduate of Domestic Science or Family and Consumer Sciences (Home Economics) from the University of Wisconsin. She has 7 years of experience Working with the strategic section of BestBuy and now writing full-time for Homeeon.

From Managing the Home, Interiors, Cleaning, and Exteriors to Gardening and everything about Making A Home Liveable – is her passion and this Homeeon is the result of this.

Emma loves decorating her home with the best stuff found online. She cares about quality over anything and writes reviews about them here in Homeeon. Get in touch with her over Pinterest.

Keep reading her blogs.